Time horizons may even be an important factor for individual investment portfolios. Younger buyers https://www.globalcloudteam.com/ with longer time horizons to retirement could additionally be willing to put cash into greater danger investments with greater potential returns. Older buyers would have a special threat tolerance since they’ll want funds to be extra available.

A project staff might implement risk mitigation strategies to identify, monitor and evaluate risks and penalties inherent to finishing a particular project, similar to new product creation. Risk mitigation also includes the actions put into place to deal with points and effects of these issues concerning a project. Risk Analysis must think about the sensitivity of data risk level definition processed and saved by the system, as well as the probability and influence of potential risk occasions. We use a easy methodology to translate these chances into danger ranges and an total system threat degree.

In enterprise risk management, managing risk is a collaborative, cross-functional and big-picture effort. Having credibility with executives throughout the enterprise is a should for threat leaders of this ilk, Shinkman said. Thus, a risk administration program ought to be intertwined with organizational strategy. To link them, threat administration leaders should first define the organization’s danger urge for food — i.e., the quantity of danger it’s keen to accept to comprehend its goals. Some risks will match inside the risk appetite and be accepted with no additional action needed. Others will be mitigated to scale back the potential unfavorable results, shared with or transferred to another get together, or averted altogether.

SafetyCulture is a digital inspection platform companies can use to identify, analyze, communicate, and handle risks effectively. Together with Mitti, a technology-first insurance firm, SafetyCulture rewards businesses which would possibly be proactive in managing their dangers. Lenders for personal loans, traces of credit, and mortgages also conduct danger assessments, known as credit checks.

Risk evaluation includes establishing the likelihood that a threat occasion may occur and the potential outcome of every occasion. Risk evaluation compares the magnitude of every danger and ranks them based on prominence and consequence. As a general rule, networked techniques that course of regulated data (e.g. HIPAA, FERPA, FISMA, ITAR, PCI-DSS and so on.) are thought of high-risk techniques. This is as a end result of the probability of compromise is (at a minimum) potential, whereas the impression (due to regulatory or industry standard violation) is considered a extreme loss of confidentiality. As part of the Comprehensive Primary Care Plus program, we get detailed utilization data on enrolled sufferers.

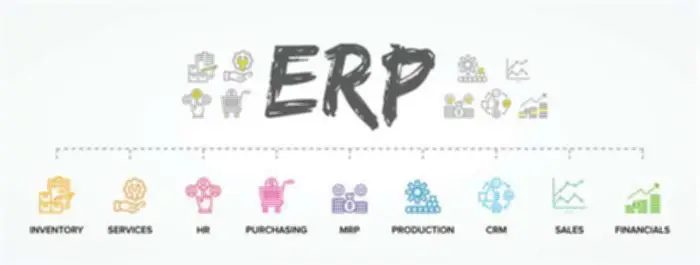

It is necessary for organizations to frequently review and replace their danger management strategy to make certain that it stays effective and relevant. This may be done by conducting regular threat assessments and incorporating feedback from stakeholders. Risk management is the process of figuring out, assessing and controlling financial, authorized, strategic and safety risks to an organization’s capital and earnings. These threats, or dangers, could stem from all kinds of sources, including monetary uncertainty, authorized liabilities, strategic administration errors, accidents and pure disasters.

We can also say with 99% certainty that a $100 investment will solely lose us a most of $7. So, if a given threat had an influence of $1 million and the chance of that threat was 50%, your threat publicity would equal $500,000. SafetyCulture is a mobile-first operations platform adopted across industries corresponding to manufacturing, mining, building, retail, and hospitality. It’s designed to equip leaders and dealing teams with the knowledge and instruments to do their greatest work—to the safest and highest normal.

The risk-return tradeoff solely indicates that greater danger investments have the potential for larger returns—but there aren’t any ensures. On the lower-risk aspect of the spectrum is the risk-free fee of return—the theoretical price of return of an funding with zero threat. It represents the interest you’d count on from a completely risk-free funding over a specific time period. In theory, the risk-free price of return is the minimum return you’d expect for any investment because you wouldn’t accept additional danger except the potential rate of return is larger than the risk-free fee. A CVE rating is calculated based on the potential damage level and the chance of an assault on that vulnerability.

In this example, danger analysis can result in higher processes, stronger documentation, extra robust inner controls, and danger mitigation. Examples of qualitative danger instruments include SWOT analysis, cause-and-effect diagrams, choice matrixes, and recreation theory. A agency that wishes to measure the influence of a safety breach on its servers may use a qualitative danger method to assist prepare it for any lost earnings that will occur from a data breach. Qualitative danger evaluation is an analytical method that doesn’t determine and evaluate risks with numerical and quantitative ratings.

The kinds of threat evaluation required within any workplace ought to be proportionate and related to the operational activities being undertaken. In many industries, there are particular legislative necessities that apply. For instance, in environments the place hazardous substances are used a Control of Substances Hazardous to Health Assessment (COSHH) must be accomplished (for more information see What is COSHH?). For any given vary of input, the model generates a spread of output or outcomes. Risk managers analyze the mannequin’s output utilizing graphs, scenario evaluation, and/or sensitivity evaluation to make choices about mitigating and dealing with the dangers. Under quantitative threat analysis, a risk model is constructed utilizing simulation or deterministic statistics to assign numerical values to threat.

It is backed by the total religion and credit score of the us government, and, given its comparatively brief maturity date, has minimal rate of interest exposure. Riskless securities usually form a baseline for analyzing and measuring threat. These forms of investments supply an expected fee of return with little or no or no danger. Oftentimes, all types of investors will look to these securities for preserving emergency financial savings or for holding assets that need to be instantly accessible.

Get insights to higher handle the danger of a knowledge breach with the newest Cost of a Data Breach report. While these examples are meant to help in the classification course of, the unique context of a selected dataset or use case could influence the general classification category. If doubtful as to the suitable classification class for a selected set of data, information owners should contact IS&T’s Information Security Office for assistance. While most investment professionals agree that diversification can’t guarantee against a loss, it’s crucial element to helping an investor reach long-range monetary goals, whereas minimizing risk. Country threat refers back to the risk that a rustic will not be ready to honor its monetary commitments. When a rustic defaults on its obligations, it can hurt the performance of all other financial instruments in that country—as properly as different international locations it has relations with.